Pension Calculate as per ROPA 2019

Pension as per ROPA 2019 has been discussed in detail in this blog.

Types of Pension

Compensation Pension

When a permanent post is abolished, the employees in that post are forced to retire. Compensation Pension is given to those employees.

Invalid Pension

Invalid Pension is paid if an employee retires due to infirm or unhealthy, physical or mental weakness.

Superannuation Pension

Employees are given Superannuation Pension if they retire on time due to old age i.e. according to the service conditions.

Superannuation Pension is the pension that an employee gets when he retires at the age of 60 years. Minimum qualifying service for superannuation pension should be 10 years. In this case, it should be remembered that if he retires at the age of 60 years according to the service rules, then he should not leave the service voluntarily, in this case his pension should be calculated.

Retiring Pension

If someone wants to retire after 20 years of service, the employees are given a Retiring Pension.Retiring Pension is admissible when an employee completes at least 20 years of satisfactory service.

Among the above four types of pension, superannuation pension and retiring pension are very important and discussed topics.

Details about Superannuation Pension and Retiring Pension are discussed in this blog.

To determine these two types of pension, you must first know about Qualifying Service, Length of Service and Units of Service.

Qualifying service for Pension

Qualifying service and Length of Service are almost the same i.e. if an employee's Qualifying Service is 14 years, his Length of Service will also be 14 years.

Formula for determining qualifying service

We have to remember that if the service period is X years 1 or 2 months, then the qualifying service will be X years. But, if the period of service is X years and 3,4,5,6,7 or 8 months, then the Qualifying Service has to be calculated by adding 0.5 years to the X years. If the period of service is X years and 9,10,11 or 12 months, then X years plus 1 year to determine Qualifying Service.

Example:

We know that Superannuation Pension is available if Qualifying Service is 10 years.

If an employee's qualifying service year is 9 years 9 months or 9 years 10 months or 1 day is left to complete the service period of 10 years, then he will not be considered for Superannuation Pension.

Many of you will say that the formula of Qualifying Service is shown above, according to that formula, if an employee has a service period of 9 years and 9 months, it should be 10 Years Qualifying Service.

But that won't happen here.

You have to remember that for those whose service period is 10 years or more, the above Qualifying service formula is applicable.

For those whose service period is less than 10 years, the above qualifying service formula is not applicable.

Service period must be 10 years for qualifying service.

Units of service for Pension

Formula to determine units of service

Units of Service=

Qualifying Service × 2

Example:-

The maximum qualifying service and maximum units of service for determining pension will be 20 years and 40 units respectively.

Pension Calculate

You have to remember that if the qualifying service is 20 years or more, the formula used to determine the pension will be different if the qualifying service is from 10 years to 20 years. Pension is not available if qualifying service is not minimum 10 years.

Retiring Pension calculate

First let me tell you, if the employee has 20 years or more qualifying service, what kind of pension will that employee get?

In Order Number 536-F(Pen) of ROPA 2019 {dt. 01.10.2019} If the Qualifying Service is 20 years then 50% of the Last Basic Pay will be an employee Basic Pension.

Basic Pension =[{Last Basic Pay × Max Qualifying service(20)}× 2] × 1/20

=Last Basic Pay ÷2

But it is always difficult to determine Pension Formula with Qualifying Service. So see how to calculate Pension with Units of Service.

Basic Pension=

[{Last Basic Pay × Units of service (max 40)} ÷ 2] x 1/40

We will call it a retirement Pension.

Superannuation Pension calculate

How to determine Pension Formula in case of Qualifying Service from 10 years to 20 years i.e. How to determine Superannuation Pension is discussed in detail below.

Superannuation Pension

= (Last Basic Pay × Qualifying Service ) ÷40

OR… ..

Superannuation Pension =

( Last Basic Pay × Units of Service)÷80

Gross Pension calculate

One thing to remember is that DA will be calculated on Basic Pension. Gross Pension will be calculated by adding Medical Allowance and DA to Basic Pension.

Gross Pension =

Basic Pension + DA + MA (500) - Commutation Value

Irrespective of the number of years of service of an employee, the maximum qualifying service and maximum units of service for determining pension will be 20 years and 40 units respectively.

According to ROPA 2019, the minimum Basic Pension is Rs 8500 and the maximum Basic Pension is Rs 1,00,500 .

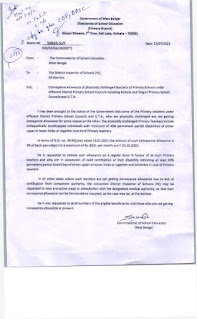

Pension related Notification

Comments