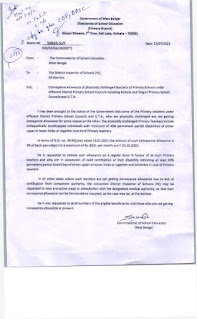

Notification of Calculation of Income Tax on interest on GPF

Subject : Calculation of Income Tax on interest on GPF - Regarding.

In pursuance of Department of Revenue’s Notification No.95/2021/File No.370142/36/2021-TPL dated 31.08.2021, all the GPF subscribers whose GPF subscription Is over Rs.5,00,000/(Rupees Five Lakhs only) in the Financial year 2021-22 are required to intimate about the interest earned by them before salary bills for the month of February, 2022 are prepared for deduction of TDS from the pay and allowances.

2. In view of the above, you are requested to please instruct your DDO to calculate Income Tax for the Financial Year 2021-22 in accordance with the Notification of Department of Revenue mentioned ibid.

This issues with the approval of the Competent Authority.

Comments