Calculate of Gratuity as per ROPA 2019

I will discuss Gratuity in this blog.

Before determining the formula of gratuity, we will know what the rule of gratuity was before and what is the rule now.

According to DCRB 1971 and DCRB 1974, the maximum gratuity rule was = (Last Basic Pay +DA) ×15.

The question is why is it multiplied by 15? According to DCRB 1974, the 6 months service period of qualifying service of an employee is calculated as 1 unit and his 1 year qualifying service is 2 units. As per DCRB 1974 Maximum Qualifying Service will be 30 (in case of Gratuity) and maximum Units of Service will be 60. Gratuity is maximum Units of Service One-fourth (1/4) i.e. 60÷4=15 times. So multiply by 15 in the above formula.

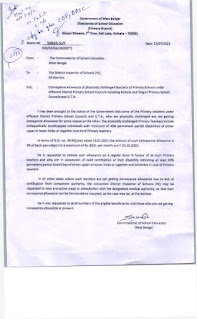

It was then notified through a Revised Order of DCRB 1974 {of which G.O No. 5225-F dt. 07.06.1976} Maximum Qualifying Service (in case of Gratuity) has been increased from 30 to 33. As a result, the maximum Units of Service has also increased from 60 to 66. And instead of 15 in the gratuity formula, 16.5 will be multiplied. Because we already know that Full Gratuity is One-fourth (1/4) of Units of Service.

As per G.O No. 26-SE(B) dt. 02.02.2009...

The Maximum Amount of Gratuity has changed time and time again considering the circumstances. First G.O No.1127-F(Pen) dt. 27.10.1998 maximum gratuity amount was increased to Rs.250000, later as per Ropa 2009 {201-F(Pen) dt. 25.02.2009} was Rs 600000 . As per Latest Order Ropa 2019 {535-F(Pen) dt. 1.10.2019} has been Rs 1200000.

So, if the Qualifying Service or Units of Service is 33 or 66 respectively, an employee will get gratuity of maximum Rs 1200000 at the time of his retirement.

Calculate of Gratuity

2 Formulas for determining Gratuity…

Formula in case of 10 years or more qualifying service

Another Formula in case of Less than 10 years

10 years Or more Gratuity formula

10 years Or more Gratuity formula= {(Last Basic Pay + DA)× Units of Service} ÷ 4

Less than 10 years, the Gratuity formula

If an employee's Qualifying Service is less than 10 years, the Gratuity formula will be =

{(Last Basic Pay + DA) × Units of Service} ÷ 2

Comments